Step 1: 📋 Dashboard Layout Overview

🔹 Left Side Menu:

- Trades → Log and view your trades

- Overview → See your overall profit, win rate, and performance

- Detailed → Deep dive into your trading patterns

- Calendar → Visual view of your daily wins and losses

- Trading Plan → Your custom AI-generated strategy based on your performance

✅ Action: Familiarize yourself with this menu — you’ll use it daily!

Step 2: ➡️ How to Add Your Trades

You have 3 ways to input trades:

- Manual Input: Type them in yourself

- Excel Import: Upload using a template

- Broker Import (Auto-Sync): Connect directly to Tradovate

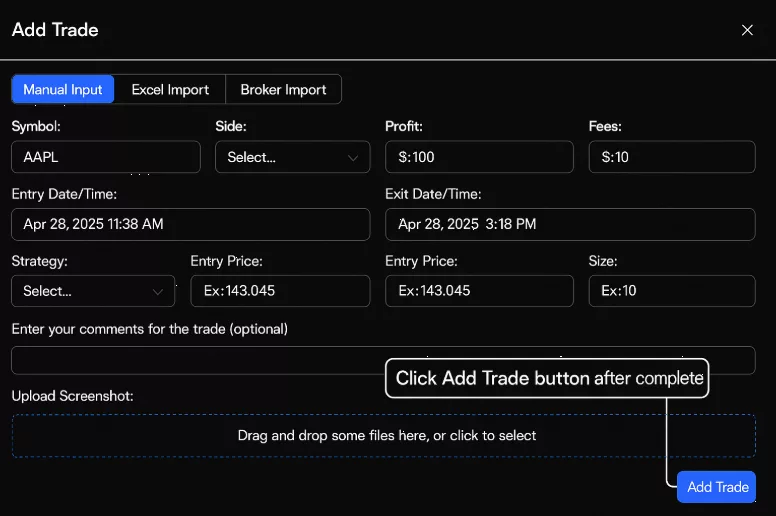

🔵 Manual Input (Fastest Way for Beginners)

When you click Add Trade ➡️ Manual Input tab:

- Symbol: What you traded (Ex: NAS100, AAPL)

- Side: Buy or Sell

- Profit & Fees: Enter how much you made/lost and any fees

- Entry/Exit Date & Time: Use the calendar/time picker

- Strategy: Select the strategy used (or add a new one)

- Entry/Exit Price: Price you entered and exited at

- Size: Number of contracts/shares

- Comments: (Optional) Add notes why you entered

- Upload Screenshot: (Optional) Drag a chart screenshot

✅ Action: After entering everything, click Add Trade at the bottom right.

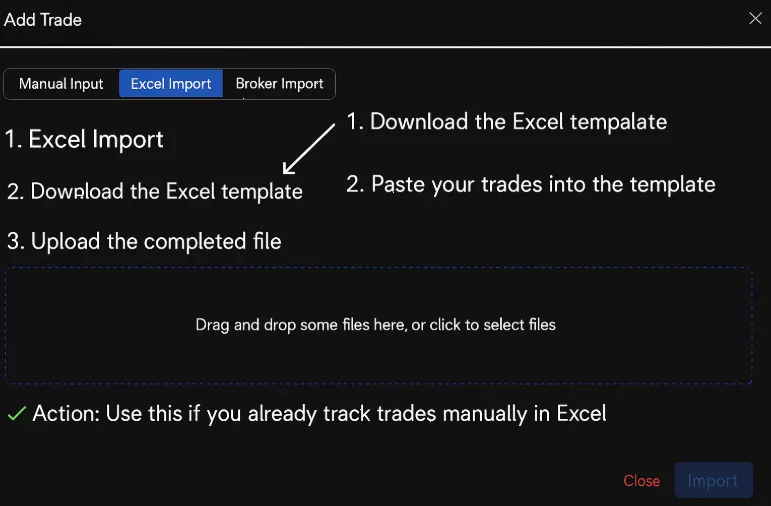

🔵 Excel Import

Download the provided Excel template, paste your trades into it, and upload it back. This may require you to export the trades from your broker and paste the data into the appropriate columns in the Excel template file.

✅ Action: Use this if you already track trades manually in Excel or have the ability to export trades from broker.

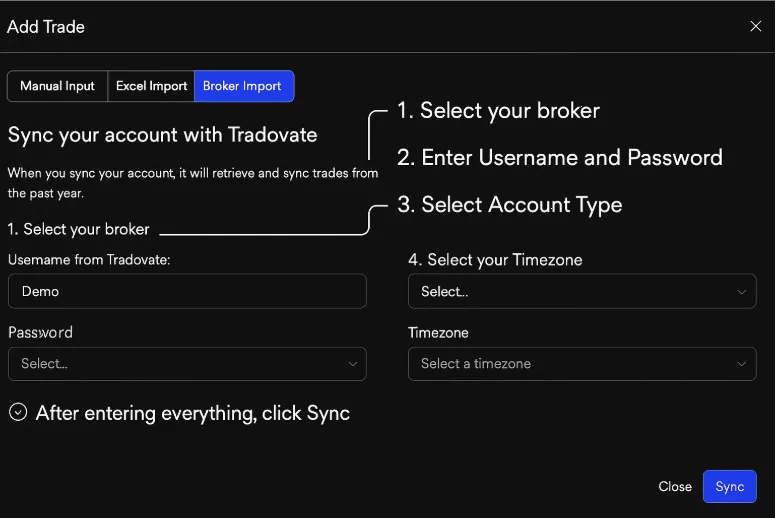

🔵 Broker Import (Auto-Sync)

Connect to broker (eg. Tradovate) to automatically pull your past trades:

- Select Tradovate (Auto-Sync).

- Enter Username and Password.

- Choose Account Type and Timezone.

- Click Sync.

✅ Action: After syncing, your trades will appear automatically — no manual work!

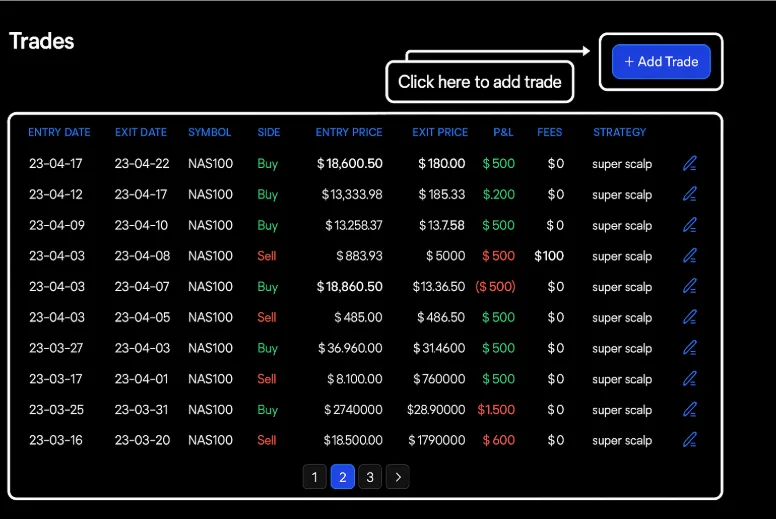

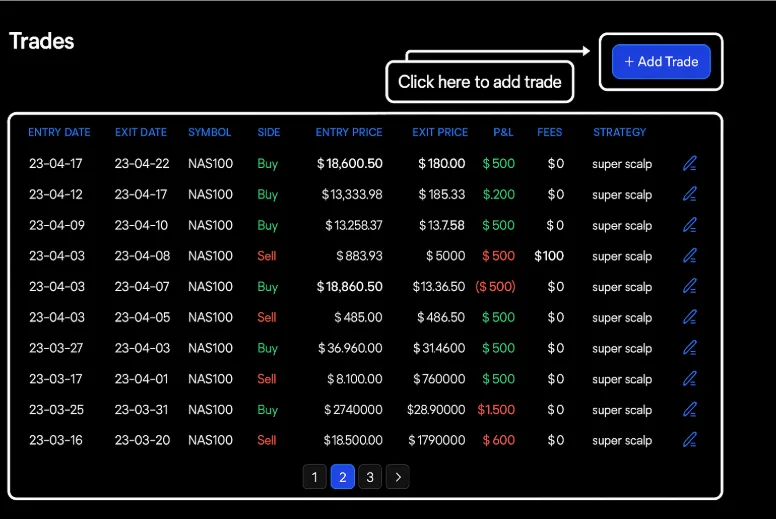

Step 3: 📈 Viewing Your Trade Records

(Ref: “Trades” Screenshot)

In the Trades tab, you’ll see a list of all your logged trades:

- Sort by: Entry Date, Exit Date, Symbol, Side (Buy/Sell), Profit/Loss.

- Actions: Edit (pencil icon) or View (eye icon) your trades.

✅ Pro Tip: Keep your records updated daily!

Step 4: 🧠 Analyze Your Performance

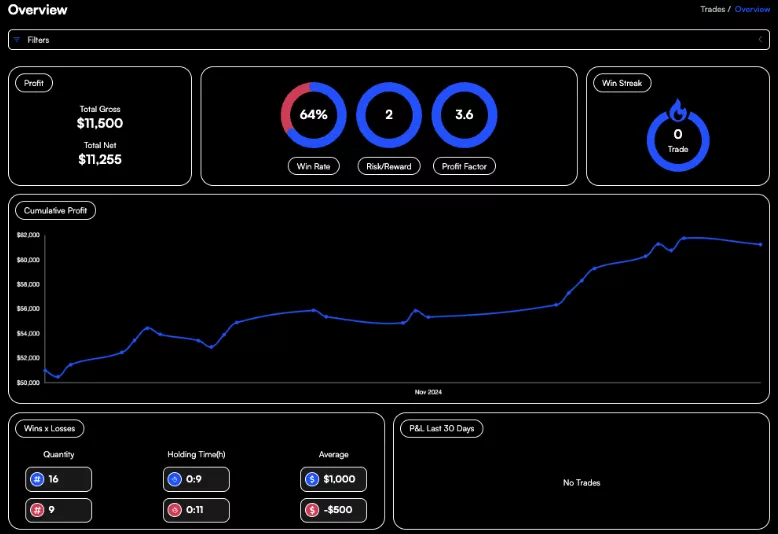

🔵 Overview Tab (Big Picture)

- Total Gross/Net Profit: Full summary of your results

- Win Rate: How often you’re winning

- Risk/Reward Ratio: How much you win compared to what you risk

- Profit Factor: Higher = better (aim for 2+)

- Cumulative Profit Graph: See your growth over time

✅ Action: Check this weekly to stay motivated and find trends.

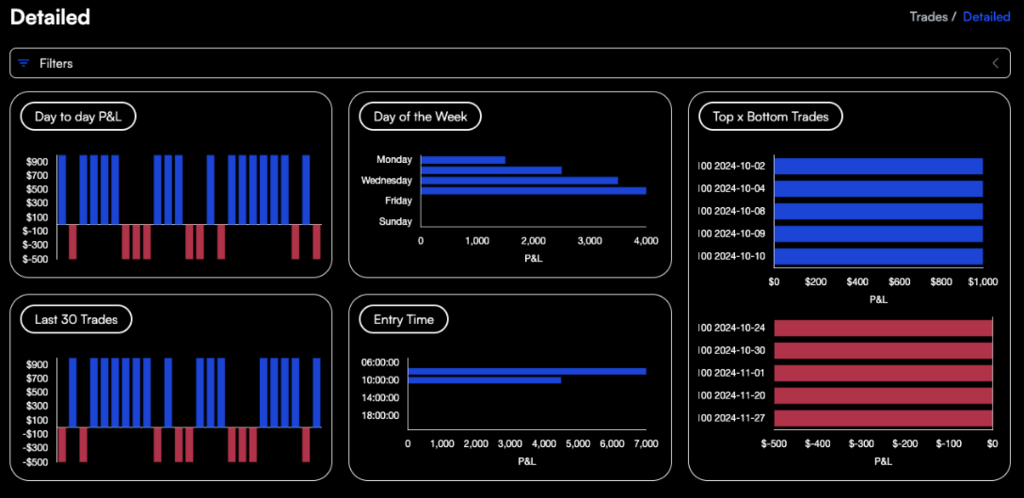

🔵 Detailed Tab (Find Your Edge)

- Day-to-Day Profit/Loss: Spot winning/losing days

- Best/ Worst Trades: Know what trades worked or failed

- Best Days to Trade: Find your most profitable weekdays

- Best Entry Time: Find your most profitable time of day

✅ Action: Focus on trading at your strongest times!

🔵 Calendar Tab (Visualize Progress)

- Blue = Winning Trades

- Red = Losing Trades

✅ Action: Look for patterns — Are Mondays tough? Are Wednesdays your best?

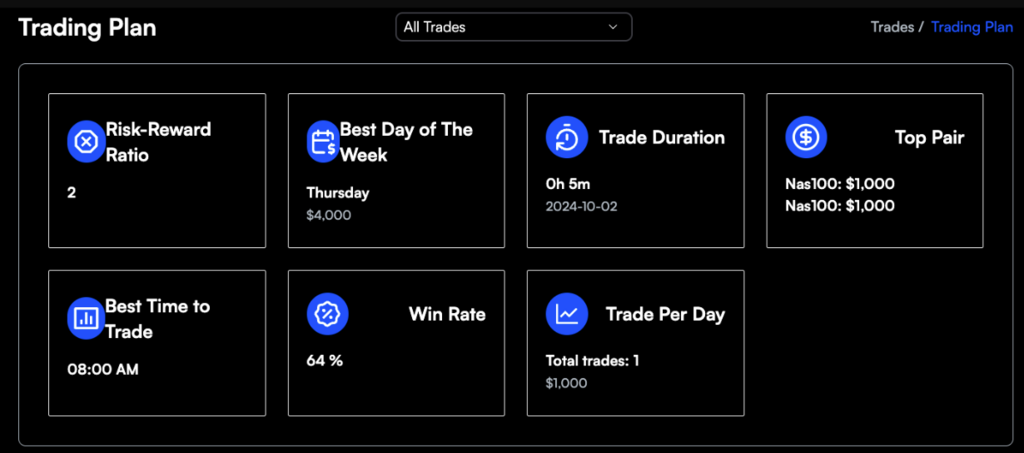

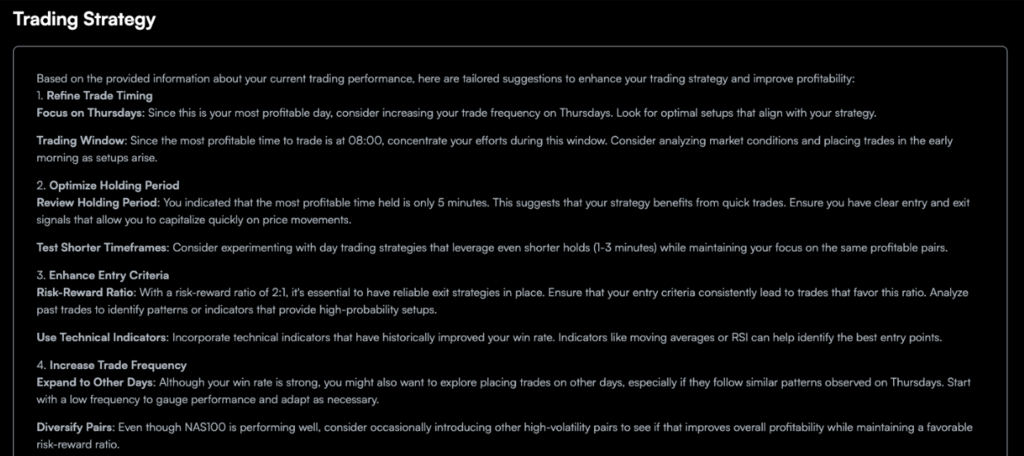

Step 5: 📚 Trading Plan – Custom AI Strategy

Your current plan based on your trading habits:

- Risk-Reward Ratio: 2:1

- Best Day to Trade: Thursday

- Best Time to Trade: 8:00 AM

- Top Trading Pair: NAS100

- Average Trade Duration: 5 minutes

- Win Rate: 64%

✅ Action: Focus most of your trading activity around these strengths!

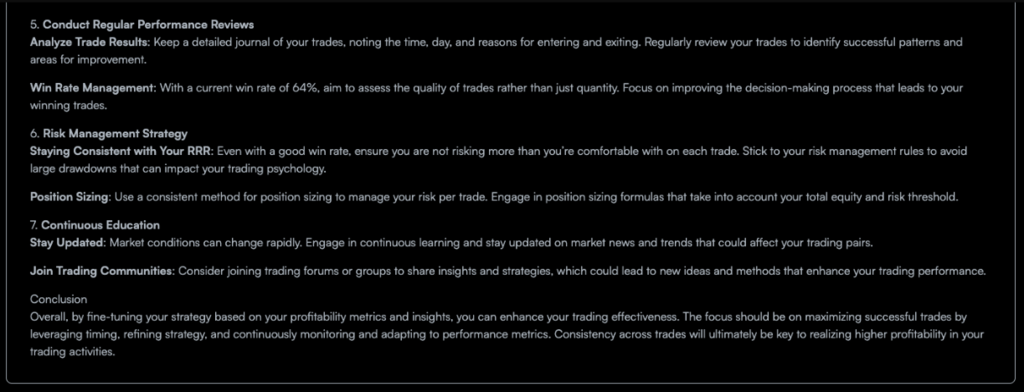

Step 6: 🎯 Custom Strategy Improvements

Tailored advice to improve:

- Refine Timing: Trade mostly on Thursdays around 8 AM.

- Shorten Holds: Focus on quick trades — 1 to 5 minutes.

- Sharpen Entry Points: Use indicators like Moving Averages and RSI.

- Expand Trading Days: Start testing similar setups on other days too.

- Manage Risk: Stick tightly to your risk per trade and keep your reward larger.

- Join Communities: Stay connected to other traders and keep learning.

✅ Action: Apply ONE improvement each week to avoid overwhelm.

🚀 Final Tips for Success

- ✅ Log your trades daily.

- ✅ Review your Overview and Detailed tabs weekly.

- ✅ Follow your custom Trading Plan.

- ✅ Make small improvements over time.

- ✅ Stay disciplined with your risk management.

- ✅ Always be learning!

Consistency builds your account. Not magic. Not luck. Discipline.